Social Liquidity

Social Liquidity

Before the birth of Uniswap, the term "liquidity" was not widely used to describe the efficiency of a pair; instead, centralized exchanges preferred the terms "depth" or "volume" Liquidity in DeFi typically refers to the total amount of liquidity in a pair as well as the pair's balance. A pair is also referred to as a "Pool", and the more tokens a pool has and the more evenly distributed (almost 1:1) it is, the better the pool's liquidity. Moreover, because of the Router mechanism (cross-pool token swap), the more pools that have access to the same token, such as ETH or WBTC, the higher the liquidity of this token.

Similar to this, Social liquidity is defined as the number of individuals that can be distributed in the same information distribution unit (e.g., group or channel). Take for instance how Discord, Telegram, and WeChat are compared. Discord allows for the grouping of all users into a single server, whereas Telegram requires the creation of multiple language groups and WeChat requires the creation of numerous groups due to its maximum user size. As a result, Discord is superior to Telegram and WeChat in terms of social liquidity (Discord, Telegram, Wechat).

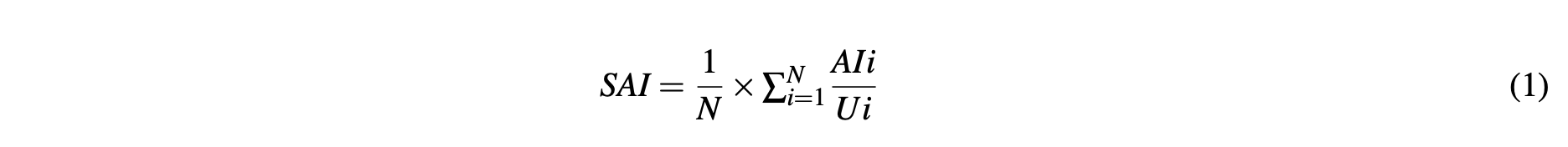

The Social Aggregation Index (SAI) could measure the degree to which social features contribute to the aggregation of users and assets. A potential formula might be:

Where:

- AIi is the Aggregation Impact, measured by user retention or engagement metrics

- Ui is the number of Users interacting with the ith feature.

- N is the total number of social features on the platform.

The social liquidity shall be fully decentralized and not rely on specific controller. Generating by contract addresses, anyone could create a token gated information unit to provide social liquidity.